Business Owners: Are You in Compliance with Minimum Wage, Overtime, and Equal Pay Laws?

MINIMUM WAGE, OVERTIME PAY, AND EQUAL PAY IN CALIFORNIA

Under the Fair Labor Standards Act (FLSA), employees across the United States are guaranteed certain rights to ensure they are fairly compensated and not unfairly overworked. It is crucial for all American employers to have an understanding of the various wage and hour laws that exist, so they not only remain in compliance with these laws and avoid penalties, but also give their employees a healthier and more attractive work environment.

Here is a quick overview of some of the wage and hour laws all employers should know.

Minimum wage information in California

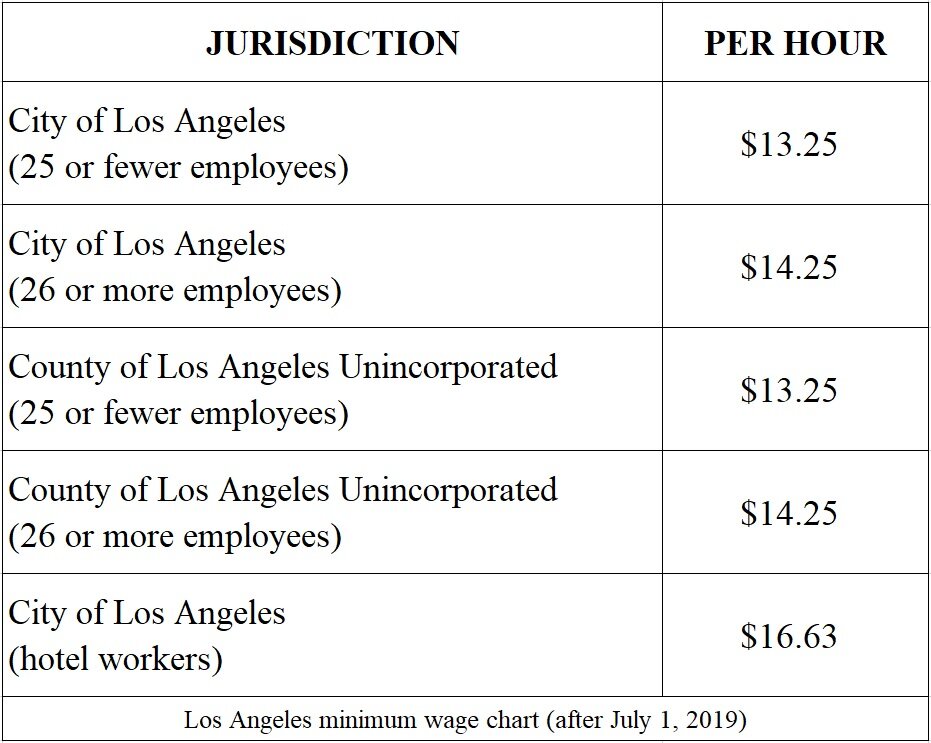

Currently the federal minimum wage is $7.25 an hour, but some states and cities have different rules, so it is important to know the minimum wage for the area your business is located in. Use this chart to track the minimum wage for your locality or city in California.

Even employers not covered by the FLSA are still required to pay workers their state’s minimum wage. Hourly employees must be paid the minimum wage for all of their hours worked—it cannot be an average, or payment of less than minimum wage for some hours worked and more for other hours.

What if employees receive tips or commissions?

For employees that make tips as part of their jobs, employers can pay less than the minimum wage and count tips toward the minimum wage requirement. However, the amount of wages plus tips must add up to at least the minimum wage—otherwise the employer must make up the difference.

For employees who are paid with commissions, those commissions can take the place of wages, but again, the amount of wages plus commissions must be at least the minimum wage.

If you are not sure how these wage calculations should be made, contact our employment law attorneys immediately for a free consultation to discuss your payroll practices.

What is overtime pay?

The FLSA does not have any limit for the number of hours an employee can work in a week. However, the federal law does require covered workers who work more than 40 hours per week to be paid overtime.

Overtime pay is one and a half times (1.5x) an employee’s typical rate of payment. This is primarily for workers who are paid by the hour, not workers who are salaried.

How is overtime pay calculated in California?

Example: Let’s say Bob works for $10 per hour. In a typical 40-hour work week, he would make $400.

For any overtime that Bob works, he is paid at a rate of $15 per hour using the overtime formula of 1.5x regular pay: $10 x 1.5 = $15.

If Bob works 10 overtime hours in a week, he would be paid $10 per hour for the 40 hours, as well as $15 per hour for overtime: $400 + $150 = $550 for 50 hours worked.

Here is a breakdown of Bob’s regular pay plus overtime pay:

($10 x 40 hours = $400) + ($15 x 10 overtime hours = $150) = $550.

Employers who have tipped employees should also know that tips do not count as part of regular pay rates when calculating overtime pay—just the guaranteed wage from the employer.

Equal pay, equal work

Men and women who perform the same jobs that require equal responsibility and skill must be paid the same wages and benefits. However, differing payments are allowed based on seniority, merit, or factors other than sex.

California employers must make sure they’re compliant with labor laws

Our attorneys have highlighted just a few of the most important wage and hour laws you should know as an employer.

To make sure you’re compliant with the FLSA and current wage/hour laws, contact Amity Law Group’s experienced labor law attorneys. Fill out this form or call (626) 307-2800.

ASK AMITY SHOW: WHY YOUR BUSINESS NEEDS AN EMPLOYEE HANDBOOK