What Employers Must Know about the Rise of California’s Minimum Wage and Paid Family Leave Benefits

In April 2016, California Governor Jerry Brown gave his approval to legislation that will gradually boost the minimum wage for California workers to $15.00 by 2022. The Governor also gave his approval to a bill which changes the income-based formula used to determine benefits stemming from a leave of absence that is subject to coverage under California’s Paid Family Leave (PFL) or State Disability Income (SDI) systems and which pertains to leave periods beginning January 1, 2018.

Another upcoming change to employment-based state programs employers should note is that, effective January 1, 2018, there will no longer be a 7 day waiting period without pay for PFL benefits. The removal of this requirement is likely to lead to increased usage of PFL benefits by employees.

These changes make it incumbent on California employers to pay close attention to the various wage and benefit-related provisions they are subject to. Close monitoring of state, local and federal minimum wage and benefit rules is recommended. Some localities may have minimum wage requirements that vary from those imposed by the state. One example is the City of Los Angeles, where the minimum wage will rise to $10.50 an hour as of July 1, 2016, and will be $15.00 per hour in 2020.

Employers must notify employees of the new minimum wage rate, and perform updates to posted notices. In addition, they will need to determine if increasing the hourly wages or salaries of certain employees is necessary to remain compliant with wage and hour exemptions promulgated by the state that depend on the state’s minimum wage for determination of eligibility. Another issue to consider is that different locales within the state may have additional requirements for paid parental leave. In San Francisco, employees who perform work within the city limits are subject to increased paid parental leave in the form of additional employer contributions above and beyond the amounts provided by the state.

The main points of both laws are summarized below:

Minimum Wage Increases:

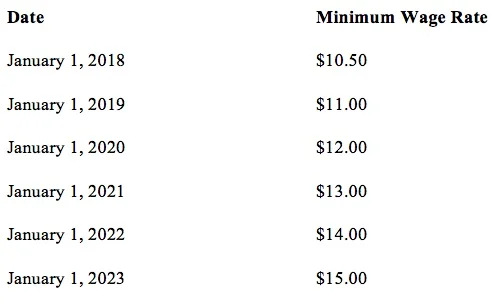

California employers employing 26 or more workers must increase minimum wages for those workers as follows:

California employers employing 25 or less workers must increase minimum wages for those workers as follows:

Increases to Paid Leave Benefits:

Current state law grants employees who are covered six weeks of family leave to be paid at 55% of their compensation for time away from work allowing them to care for seriously ill or injured family members or for the purpose of bonding with a minor child. In the latter case, the time off must be taken within a year of the birth of the child or the child’s placement as a result of adoption or a foster care assignment. The SDI program delivers benefits to people who are prevented from working by illness or injury. Funding for this paid leave comes from SDI payroll contributions.

In accordance with the new law, leave periods taking place on January 1, 2018 or later, and before January 1, 2022, will use the following method for calculating weekly benefit amounts:

- If wages paid in the highest-income quarter are below $929; the weekly benefit amount is $50

- If wages paid in the highest-income quarter are $929 or more but the amount is less than 1/3 of the average quarterly state wage; the weekly benefit amount is 70% of the amount of wages paid in the highest wage quarter, divided by 13

- If wages paid in the highest income quarter are at least 1/3 of the amount of the state average quarterly wage; the weekly benefit amount is the greater of 23.3% of the state average weekly wage; or 60% of the amount of wages paid in the highest wage quarter, divided by 13.

CALL US FOR A FREE CONSULTATION

If you and your company need legal representation to ensure that you comply with the new California employment and labor laws, call Amity Law Group today at (626) 307-2800 to consult with our experienced employment law attorneys and for a free consultation.